Frankly, I’ve always been stupefied by the fact that Switzerland has been able to thrive in the international community by laundering cash from narco-traffickers, kleptomaniacs and tax cheats while countries like Columbia (during the 1980s) and Guinea-Bissau (today) have been condemned as narco states.

Therefore, if you’re one of the hundreds of thousands of Americans who have used offshore accounts to evade taxes, you might want to plea bargain with the U.S. Department of Justice before the Swiss and other tax havens are obliged to name you as a fugitive – with all of the financial and criminal implications that entails

[US forcing Swiss to give up its hallowed bank secrecy laws, TIJ, February 26, 2009]

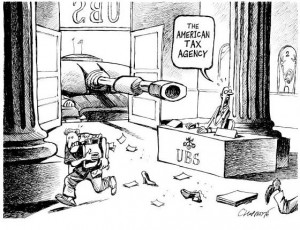

This was the indignant note I sounded earlier this year when bank officials from UBS, the biggest bank in Switzerland, insisted that disclosing the account details of wealthy Americans suspected of tax evasion was against Swiss law and deleterious to the country’s strategic economic interests.

This was the indignant note I sounded earlier this year when bank officials from UBS, the biggest bank in Switzerland, insisted that disclosing the account details of wealthy Americans suspected of tax evasion was against Swiss law and deleterious to the country’s strategic economic interests.

Therefore, I was heartened yesterday by reports that UBS has finally agreed to out about 5000 American clients, with accounts totaling $18 billion, pursuant to an unprecedented tax information exchange agreement between Switzerland and the US.

But the real story here is that about 5000 Americans reportedly heeded my advice to plea bargain before it was too late. And even though they will be required to pay back taxes, they will probably escape prosecution.

By contrast, all of those whose account details are turned over under subpoena, effectively, will face significant tax penalties and criminal prosecution. And the IRS estimates that the Swiss will eventually provide such information on as many as 50,000 Americans….

Today Switzerland; but other tax havens, like the Cayman Islands, will undoubtedly be forced to comply with similar requests for account information from the IRS.

So tax cheats, beware….

Related commentaries:

US forcing Swiss to give up its hallowed bank secrecy laws

Leave a Reply

You must be logged in to post a comment.