Not long ago, it was heretical to even question the miracle of China’s everlasting economic growth. Nothing testified to this quite like corporations lobbying to get into its market like Evangelicals praying to get into Heaven. In fact, you’d be hard-pressed to find any Western economist, politician, CEO, or pundit who raised any doubt about the Chinese economy over the past decade.

Never mind the transformative irony in the way market economies of Western democracies blithely tethered their growth during this period to that of the planned economy of this Eastern autocracy.

By contrast, my heresy was such that I felt like a cross between Doubting Thomas and John the Baptist. Not least because I was so mindful that much of what was being said about the Chinese economy in the 2000s was said about the Japanese economy in the 1980s; that is, before Japan’s boom went bust, ushering in its infamous “lost decades” from 1991-2010.

More to the point, I raised doubts, continually. Here, for example, is an excerpt from “Gap Between Rich and Poor in Communist China Is Sowing Seeds of Resentment and Terminal Unrest,” December 22, 2005.

___________________

Despite a rate of growth that is the envy of the world, China’s economy is, in fact, a ticking time bomb. …

The affectations of modernity and freedom in China’s big cities are designed to divert attention from the feudal, barren, and collectivized rural areas where most of its billion-plus people still reside. …

The affectations of modernity and freedom in China’s big cities are designed to divert attention from the feudal, barren, and collectivized rural areas where most of its billion-plus people still reside. …

The irony is that the great proletarian revolution Karl Marx predicted for capitalist societies is finally brewing in communist China. Because as urban sprawl supplants rural areas and further alienates poor farmers (who have seen only hardship from this economic boom), the simmering tensions between the “haves” and the “have-nots” will cause China to implode, inevitably.

Fuel shortages compounded by widespread rebellion amongst poor, gentrified and disaffected farmers are clearly sowing the seeds of China’s economic destruction.

The government will continually mount Sisyphean efforts to keep this cauldron of tensions from boiling over. But I fear this will lead inexorably to a crackdown that will make the massacre at Tiananmen Square look like a Sunday picnic.

___________________

Marx famously warned that capitalism contained the seeds of its own destruction. The seeds he was referring to, of course, are resentful workers who would eventually mount a proletarian revolution against the bourgeois establishment.

Marx famously warned that capitalism contained the seeds of its own destruction. The seeds he was referring to, of course, are resentful workers who would eventually mount a proletarian revolution against the bourgeois establishment.

Except that this final stage of capitalism is now playing out in communist China, not capitalist America.

As China grows into its role as a twenty-first century economic powerhouse, its government is struggling with the growth of popular unrest. Groups of Chinese citizens, from small bands of workers to entire villages, have been staging protests across the massive nation with increasing frequency. According to research by the Chinese Academy of Governance, the number of protests in China doubled between 2006 and 2010, rising to 180,000 reported ‘mass incidents.’

(The Atlantic, February 17, 2012)

It might strike you as farfetched that China could sustain an average of 45,000 mass protests every year with nary a media mention … of any of them. This, especially given how the media can make one mass protest in America seem like, well, a revolution.

But the Chinese government has kept a lid on these protests and enforced news blackouts with carrots and sticks, respectively.

With respect to appeasing protesters with carrots (the way the Saudi regime has always done), here is the insight Maclean’s provided:

With respect to appeasing protesters with carrots (the way the Saudi regime has always done), here is the insight Maclean’s provided:

A wave of riots and protests swept across China’s industrial cities in 2008 and 2009. …

The massive stimulus program deployed by Beijing, one that was more than twice the relative size of America’s rescue plan, worked exactly as it was supposed to: It reignited growth and put China’s expanding army of restless unemployed back to work.

For the surprisingly large number of Western business types who hold that China’s model of centralized economic planning is superior to the plodding inefficiency of capitalist liberal democracies, China’s speedy response only strengthened their conviction.

(July 15, 2015)

Indeed, while hailing the Communist Party’s visible hand in every facet of life in China, these Western business types were decrying the Obama Administration’s visible hand in providing healthcare to millions of poor Americans. They were too consumed with greed to be chastened by their hypocrisy.

Indeed, while hailing the Communist Party’s visible hand in every facet of life in China, these Western business types were decrying the Obama Administration’s visible hand in providing healthcare to millions of poor Americans. They were too consumed with greed to be chastened by their hypocrisy.

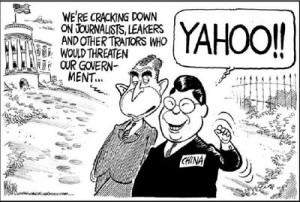

Even worse, they not only turned a blind eye to the Chinese government’s human rights abuses but actually helped it perpetrate those abuses.

Again, I’ve been preaching in the proverbial wilderness against these abuses for years:

China’s exploitation of hundreds of millions of poor Chinese for cheap labor fueled its phenomenal rise to economic superpower status. What’s more, many American corporations conspired and colluded with the Chinese government not only to exploit that cheap labor but also to deny Chinese citizens all manner of basic freedoms.

Chinese President Hu Jintao has good reason to shout, yahoo! After all, he got Yahoo!, Microsoft, Intel, and every other American hi-tech firm to check their conscience at the border as a condition of doing business in China. The viability of the Chinese government depends on its ability to control the minds and manage the freedoms of its 1.3 billion citizens.

(“Hu Advises Bush that More Spying, Not Less, Will Help U.S. Economy Grow Like China’s,” The iPINIONS Journal, April 23, 2006)

With respect to intimidating news media with sticks (the way the Russian government has always done), here is the insight the New York Times provided:

With respect to intimidating news media with sticks (the way the Russian government has always done), here is the insight the New York Times provided:

The Chinese news media covered President Xi Jinping’s most recent public appearances with adulation befitting a demigod. …

The blanket coverage reflected the brazen and far-reaching media policy announced by Mr. Xi on his choreographed tour: The Chinese news media exists to serve as a propaganda tool for the Communist Party, and it must pledge its fealty to Mr. Xi.

(February 22, 2016)

Specifically, this fealty prohibits the publication of anything remotely critical of the Maoist cult of personality Xi seems determined to cultivate. The mysterious fate of the gang of five who dared to publish ‘gossipy books about Chinese leaders” is instructive:

Specifically, this fealty prohibits the publication of anything remotely critical of the Maoist cult of personality Xi seems determined to cultivate. The mysterious fate of the gang of five who dared to publish ‘gossipy books about Chinese leaders” is instructive:

The case of Lee Bo … and his four missing colleagues has all the makings of an espionage thriller. But to many of the 7.2 million people in this former British colony, his disappearance and apparent surfacing across the border that demarcates Hong Kong from the rest of China have fueled a profound fear, by calling into question the legal guarantee that people here would be shielded until midcentury from Beijing’s reach under an arrangement known as one country, two systems.

(New York Times, January 7, 2016)

Mind you, it’s not as if any news organization needed Xi’s personal admonition. That he felt the need to issue it, however, reflects the Communist Party’s fears that the chickens are finally coming home to roost. And here’s why:

China’s debt situation is about the same size as Greece’s debt situation. [This] is a massive overhang on an economy that is slowing down now and — because of the population issue — about to slow down even more.

The scary part for other countries is that China’s economy is so huge it functions as both an engine and a supply source for the economy of the rest of the world.

(Business Insider, August 10, 2015)

Sure enough, Moody’s downgraded China’s bond rating from “stable” to “negative” just last week:

Moody’s noted that ‘government debt has risen markedly, to 40.6 percent of GDP at the end of 2015, according to our estimates, from 32.5 percent in 2012…

Concerns over the Chinese government’s growing debt in its increasingly moribund state-owned enterprises … will add further pressure to the Communist state’s fiscal position.

Another driver for the downgrade was concern over China’s growing external vulnerability, following record levels of capital flight and the PBOC’s increasingly drained foreign exchange reserves to defend the fledging RMB.

(World Finance, March 2, 2016)

Arguably, Moody’s downgrading China’s bond rating is as bad an omen as Xi warning the news media not to air his government’s dirty laundry.

It is also noteworthy that the reason for capital flight is that Xi’s government seems unwilling or unable to implement the structural reforms necessary to ensure steady growth and market stability.

It is also noteworthy that the reason for capital flight is that Xi’s government seems unwilling or unable to implement the structural reforms necessary to ensure steady growth and market stability.

This is particularly alarming given a Wall Street Journal report on January 19 that economic growth in 2015 was the slowest in 25 years (at 6.9 percent) and “shows little sign of abating.” Shocking drops in exports, which fell by 25 percent just last year, have become thorns in the “miracle-gro” that has fertilized China’s economic growth.

Yet, despite all this, Xi seems more interested in getting media bosses to help China save face than economic advisers to help vindicate the heralded virtues of its planned economy. He has clearly decided that he has a better chance of holding that proletarian revolution at bay by stoking nationalism than stimulating growth.

Hence, the reports about China’s increasingly aggressive military maneuvers in the South China Sea:

Hence, the reports about China’s increasingly aggressive military maneuvers in the South China Sea:

‘China is clearly militarizing the South China Sea, and you’d have to believe in the flat Earth to think otherwise,’ Cmdr. Harry Harris, of the U.S. Pacific Command, recently warned Congress…

The U.S. has stepped up military moves with its alliances and its military presence in the Asia-Pacific region…

China has created islands with military-grade runways and missile-defense hardware on islands claimed by Japan, Vietnam, the Philippines, Taiwan, Malaysia, and Brunei.

(Business Insider, March 4, 2016)

Incidentally, I presaged these developments too – in “China and Japan in Falklands-Like Dispute,” August 23, 2012, and “Japan and China Stoking North Korea-Like Tensions,” April 24, 2013.

In any event, China has a lot of saving face to do. For its new normal of market volatility and “scaffolding debt expansion” are making a mockery of The China Model, not to mention sending shockwaves throughout the global economy. This model, of course, is an oxymoronic social compact of political totalitarianism and economic liberalism. Renowned scholars like Harvard professor Daniel A. Bell have been touting it as an equally viable, if not better, alternative to the U.S. model (both politically and economically).

And, Chinese officials believed the hype; so much so that they began lecturing American officials about sound fiscal management. They did so with imperious indignation five years ago, for example, after ratings agency Standard & Poor downgraded America’s bond rating – not from stable to negative, but merely from AAA to AA+.

The world’s largest holder of U.S. debt, condemned the ‘short-sighted’ political wrangling in the U.S. and said the world needed a new and stable global reserve currency.

The official Xinhua news agency said China had ‘every right now to demand the United States address its structural debt problems and ensure the safety of China’s dollar assets.’

(London Guardian, August 6, 2011)

Given subsequent developments, the aphorism “karma’s a bitch” only hints at the comeuppance the Chinese are now suffering. But I cautioned them about their superpower hubris in this respect in “Communists Lecture Capitalists at World Economic Forum in Davos,” January 29, 2009, which includes the following:

All economic indicators give Wen and the Chinese just cause to be full of themselves. Forecasts have their economy growing at a rate of eight percent this year, despite the global financial crisis. Granted, this is lower than the double-digit growth they’ve been averaging in recent years. But it’s still well above anything the U.S. has experienced in decades.

I would not be surprised, however, if the foundations of China’s economy turn out to be even more unsustainable than that of the U.S. After all, China cannot continue riding its real-estate boom on the ownership aspirations of consumers whose credit per capita is even less solvent than that of the sub-prime consumers in the U.S. who caused its real-estate boom to go bust.

To get an eerie visual of how this bust is now unfolding, google and watch the 60 Minutes video of “China’s Ghost Cities” — featuring thousands of abandoned development projects:

To get an eerie visual of how this bust is now unfolding, google and watch the 60 Minutes video of “China’s Ghost Cities” — featuring thousands of abandoned development projects:

Wang Shi, CEO of Vanke told 60 Minutes that developers are deep in debt. Many have abandoned projects midway through because the money dried up. He warned that if the bubble really did burst, China could see its version of the Arab Spring.

(Business Insider, March 3, 2013)

Which brings me back to the ominous point about Xi’s media tour last week. Because the more China’s economy slows, the less stimulus money the government will have to keep restive workers in check; the less stimulus money the government has to keep restive workers in check, the more repressive the government will become; and the more repressive the government becomes, the more the media will feel duty-bound to cover-up its human-rights abuses.

In other words, the stage is now set for China to crackdown with impunity on the unrest this economic slowdown is bound to cause. And nothing is more ominous in this respect than Reuters reporting on March 3 that the government plans to “lay off 5-6 million state workers over the next two to three years.”

It has earmarked billions to induce these redundant zombies not to join the ranks of economic walking dead who rise up for the 45,000 protests per year cited above. But this is rather like the U.S. government promising emancipated blacks forty acres and a mule….

Apropos of this, China’s economic slowdown is characterized as much by zombie companies as by ghost cities — both of which betray zombie data that made its economy appear more like a powerful dragon than a slithery gecko. But the “scary part for other countries” is that such companies and cities portend similar doom for Chinese funded developments throughout Africa and the Caribbean.

For China can no longer afford to borrow money to sustain the illusion of double-digit growth at home or the co-opting influence of yuan diplomacy abroad. The latter had it financing everything from sports stadiums in Africa to slush funds in Latin America, and tourist resorts in the Caribbean.

For example, the Baha Mar resort in The Bahamas looks like a ghost city today, in part, because China’s Exim bank can no longer fund the billions in guarantees to complete it. I warned against this white elephant in ‘China Putting the Squeeze on The Bahamas. Your Country Could Be Next,” October 22, 2010. But this headline from the January 4, 2016 edition of Bloomberg Business speaks volumes:

For example, the Baha Mar resort in The Bahamas looks like a ghost city today, in part, because China’s Exim bank can no longer fund the billions in guarantees to complete it. I warned against this white elephant in ‘China Putting the Squeeze on The Bahamas. Your Country Could Be Next,” October 22, 2010. But this headline from the January 4, 2016 edition of Bloomberg Business speaks volumes:

The Ghost of Baha Mar: How a $3.5 Billion Paradise Went Bust

This does not bode well for other developments the Chinese are financing and constructing throughout the region — invariably using their own cheap labor imported from China. Remarkably, these developments include The Pointe, another mega-resort just down the beach from Baha Mar in Nassau. The leaders of The Bahamas clearly have some ‘splainin’ to do.

Finally, apropos of Xi’s apparent pivot from stimulating growth to stoking nationalism, ponder this ominous prospect:

What happens if China decides that converting the container ports, factories, and chemical plants it has funded throughout the Caribbean [and Africa] into dual military and commercial use is it its strategic interest? Would these governments comply? Would they have any real choice? And when they do comply, would the U.S. then blockade the entire region – as it blockaded Cuba during the missile crisis?

Now, consider China making such strategic moves in Latin America where its purportedly benign yuan diplomacy dwarfs its Caribbean [and African] operations. This new Cold War could then turn very hot indeed.

(“China Buying Up Political Dominion,” The iPINIONS Journal, February 22, 2005)

North Korean leaders have gotten away with feeding their people more nationalism than food for the past 50 years. Perhaps Xi can be forgiven for thinking he can get away with feeding his people a little more nationalism and a little less food for the next 25.

Whatever the case, China appears on the precipice of emulating Japan’s lost decades, during which headlines like today’s from the Associated Press will likely become commonplace:

Global Stocks edge lower after China cuts growth target [again]

Related commentaries:

Gap between rich and poor…

Hu advises Bush…

China putting squeeze on…

China and Japan…

Communists lecture capitalists…

China buying dominion over Caribbean