Frankly, if nothing else, this latest bailout should finally destroy the myth that the US is running a capitalist, free market economy. After all, this (and the other government bailouts cited above, which effectively privatized shareholder gains and nationalized losses), coupled with longstanding corporate subsidies, is indistinguishable from the way China runs its socialist, centrally planned economy.

[Chickens come home to roost on Wall Street…, The iPINIONS Journal, September 16, 2008]

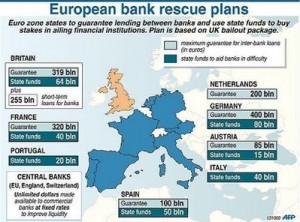

Last weekend, finance ministers from the world’s richest countries betrayed the most basic tenet of capitalism by agreeing on a multilateral plan to effectively nationalize the banking industry in their respective countries.

Last weekend, finance ministers from the world’s richest countries betrayed the most basic tenet of capitalism by agreeing on a multilateral plan to effectively nationalize the banking industry in their respective countries.

In each case, governments from the US, Europe and Japan allocated the equivalent of hundreds of billions dollars to buy stock in private banks as a means of insuring them against failure.

What this portends for capitalism, however, is not lost on Venezuelan President Hugo Chavez – who President Bush and other western leaders have continually condemned for nationalizing the banking and other major industries in his country:

This crash of capitalism and of neoliberalism will be worse than that of 1929. The world will never be the same after this crisis. A new world has to emerge, and it’s a multipolar world. We are decoupling from the wagon of death.

Nevertheless, Wall Street (and other markets around the globe) greedily endorsed this betrayal of capitalist principles by rallying from historic losses last week to historic gains yesterday – with the Dow in particular closing up 936 points, which nearly doubled its previous historic one-day rally of 499 in 2000.

Nevertheless, Wall Street (and other markets around the globe) greedily endorsed this betrayal of capitalist principles by rallying from historic losses last week to historic gains yesterday – with the Dow in particular closing up 936 points, which nearly doubled its previous historic one-day rally of 499 in 2000.

Never mind that it’s probably only a matter of days before this theoretically efficient market suffers new historic losses. Because this seems inevitable given what Business Week describes as a “$516 trillion derivatives time-bomb” waiting to explode….

(And if you don’t know what derivatives are, you have that ignorance in common with most of the money managers who have amassed this incomprehensible debt by investing in them in some netherworld corner of the global marketplace.)

Capitalism, in its quest for higher profits and new markets, will inevitably sow the seeds of its own destruction.

[Karl Marx]

But I suspect that yesterday’s historic gains will have the same effect as the plant in a street game of Three Card Monte who pretends to win a bundle only to lure suckers in who invariably lose their shirts.

Investors beware….

That said, as a Keynesian (aka a big-government liberal), I never believed the free-market fairytale that an “invisible hand” would cause profits generated by the investments of greedy corporations and rich folks to trickle down to poor folks.

Instead, I’ve always believed that government intervention was necessary not only to stimulate economic growth and regulate the private sector but also to ensure the equitable redistribution of the wealth of nations.

Therefore, bailing out Wall Street is only the first step. Because, to prove that they have really seen the light, governments in these rich, erstwhile-capitalist nations must now follow through by bailing out Main Street as well (eg. by forgiving the mortgage and credit-card debt of all citizens who make less than $100,000).

Related Articles:

Chickens come home to roost on Wall Street…

Filipe Pinto says

The invisible hand exists. The invisible hand is proportional to the market’s transparency. Market transparency needs enforcement from the market operator, in this case the government.

The Enron scandal created Sarbanes-Oxley. It failed to change the mentalities of the market operators. Instead installed a false sense of security.

This financial crisis does not represent a struggle between Friedrich Hayek and John Keynes.

This financial crisis is an opportunity to CHANGE. The real change, that actually changes things. Not another Enron post-scandal reaction.

This nation needs to know whether or not the government is going to enforce the regulation, that allows, large and small, stronger and weaker, to have the same access to information.

Asymmetric information breads inequality. Hiding information kills markets.

This nation’s regulators and market operators needs to wake to the power of event driven economies. Until that does not happen, I’m afraid we will lose time looking at past events that, in my opinion, do not apply in this situation.

For those that want to see a a 58m BBC documentary on this crisis, i strongly recommend – http://video.google.com/videoplay?docid=-4001834874264918973&hl=en

;-)