I’m not a stock analyst, and I don’t play one on this site.

That said, here’s what I wrote two years ago about the social contagion Facebook had become:

[L]et’s face it, haven’t you had enough of the mundane and often-recycled crap your ‘friends’ share … every day, several times a day? Even worse are the hucksters who keep begging you to “Like” their page so they can make money off your ‘friendship.’ Then of course there are the myriad ways those little zuckerheads get you to betray your own privacy.

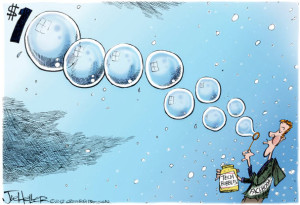

These are just some of the reasons why Facebook will soon go the way of MySpace. Remember that bubble sensation?

In the meantime, though, Zuckerberg and his circle of real friends will be laughing all the way to the bank.

(“Facebook IPO Just Floating Another Tech Bubble,” The iPINIONS Journal, May 19, 2012)

Only a diseased person would behave in the chronically self-absorbed, demented, and annoying way most Facebook junkies do. And, that over a billion people behave this way can only mean that this diseased behavior is infectious (or viral — as one might say, appropriately enough, in social-networking parlance).

Unsurprisingly, my analysis/diagnosis did not get too many “Likes” from my imaginary Facebook friends. More to the point, though, it drew nothing but indignant rolling of eyes from my real Wall Street friends. In fact, relying on the prevailing professional analysis of Facebook’s long-term health, they all suggested, in no uncertain terms, that I should stick to my day job.

Well, no less an authority than the Wall Street Journal has now reported on an unimpeachable research paper that endorses my lay analysis:

Well, no less an authority than the Wall Street Journal has now reported on an unimpeachable research paper that endorses my lay analysis:

A controversial research paper predicting Facebook’s imminent demise spread like an epidemic through the blogosphere Wednesday.

The paper, by two Princeton PhD students, said social media sites like Facebook usually follow the same growth and decline patterns of infectious disease outbreaks. The conclusion: The world’s largest social network will be more or less eradicated within the next three years.

The authors, Joshua Spechler and John Cannarella, cited MySpace, which peaked in 2008 and then rapidly shrunk to almost nothing by 2011.

(January 22, 2014)

![]() Actually, their findings mirror mine to such degree that I might have to make sure these Princeton PhDs gave me proper attribution….

Actually, their findings mirror mine to such degree that I might have to make sure these Princeton PhDs gave me proper attribution….

In any case, you might think I reacted to this report by facing my critics with vindicating shouts of, “I told you so!” But I just continued marveling at how Zuckerberg, Sheryl Sandberg, and other major shareholders have been cashing out and laughing all the way to the bank – just like I predicted.

Sheryl Sandberg’s fortune surpassed $1 billion today after Facebook Inc (FB) closed at a record high…

Mark Zukerberg, Facebook’s 29-year-old CEO, sold more than $2 billion in stock last month.

(Bloomberg, January 21, 2014)

But who can blame them for “floating stocks” while their bubble lasts, eh?

Related commentaries:

Facebook IPO…