Reports abound that Credit Suisse is about to go the way of Silicon Valley Bank and Signature Bank.

Shares of Credit Suisse on Wednesday plunged to a fresh all-time low for the second consecutive day after a top investor in the embattled Swiss bank said it would not be able to provide any more cash due to regulatory restrictions. Trading in the bank’s plummeting stock was halted several times throughout the morning as it fell below 2 Swiss francs ($2.17) for the first time. …

Investors are also continuing to assess the impact of the bank’s Tuesday announcement that it had found ‘material weaknesses’ in its financial reporting processes for 2022 and 2021.

(CNBC, March 15, 2023)

Credit Suisse on brink of collapse

Fears of collapse are now becoming self-fulfilling prophecies. The banking industry already seems infected with a 2008-style contagion. And the banking analysts swarming all media aren’t helping. Each one is vying for acclaim as the soothsayer who predicted this potential financial crisis.

Nouriel Roubini basked in vainglory for predicting the 2008 financial crisis. They are all hoping to emulate him. But I can argue that I predicted this one 13 years ago. And I have the I-told-you-so receipts.

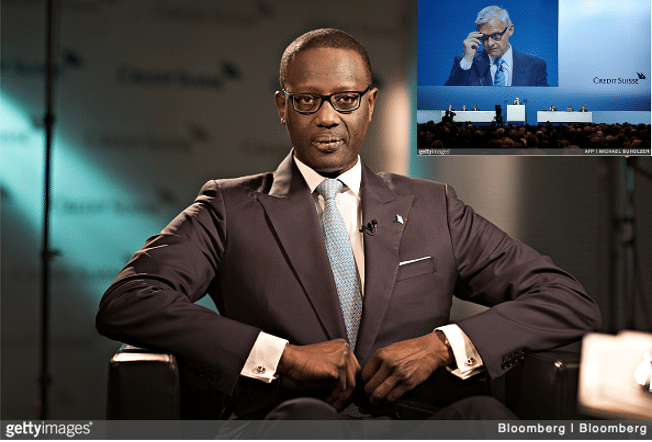

Credit Suisse fires Tidjane Thiam

I submit that Credit Suisse is also experiencing corporate karma. Granted, a “litany of crises” has it teetering on the brink of insolvency.

But this looming collapse stems from firing its first Black CEO, Tidjane Thiam, three years ago. That reeked of racial resentment.

After all, the BOD forced him to resign based on trumped-up claims of spying at the bank. This, while the bank’s White chairman was publicly praising him: It’s “to his credit that Credit Suisse is standing on a very solid foundation and has returned successfully to profit.”

Everyone in banking knew this. And, trust me, no BOD would have forced a White CEO to resign under similar circumstances.

They smeared Thiam as a black sheep. But they replaced him with a white elephant. That’s why it looks like Thiam was, in fact, a white knight. Because there’s no denying that the bank would still be on a solid foundation if he were still in charge.

Mortgages and derivatives played a metastasizing role in 2008. Bonds and interest rates are playing it in 2023. But I am convinced Thiam would have fortified Credit Suisse against this latest contagion.