I wrote a college paper almost 32 years ago on the growing gap between rich and poor in America. It was replete with all kinds of warnings about the social, political and economic consequences of this gap, almost all of which have come to pass.

Conspicuously missing, however, was any reference to CEO-to-worker pay. I hasten to clarify that this was not due to my failure, or to my thesis advisor’s oversight. It’s just that this ratio did not figure as prominently back then as other factors – like technology, regressive taxation, and offshoring – did in driving the growing gap between rich and poor.

Conspicuously missing, however, was any reference to CEO-to-worker pay. I hasten to clarify that this was not due to my failure, or to my thesis advisor’s oversight. It’s just that this ratio did not figure as prominently back then as other factors – like technology, regressive taxation, and offshoring – did in driving the growing gap between rich and poor.

My, how things have changed.

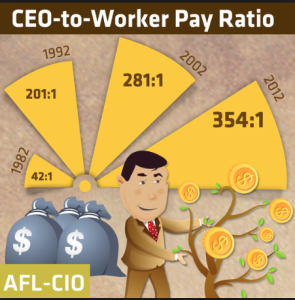

The ratio of CEO-to-worker pay has increased 1000 percent since 1950, according to data from Bloomberg. Today Fortune 500 CEOs make 204 times regular workers on average … up from 120-to-1 in 2000, 42-to-1 in 1980 and 20-to-1 in 1950.

‘When CEOs switched from asking the question of ‘how much is enough’ to ‘how much can I get,’ investor capital and executive talent started scrapping like hyenas for every morsel,’ Roger Martin, dean of the University of Toronto’s Rotman School of Management, told Bloomberg.

(Bloomberg April 30, 2013)

For a little perspective, it might be helpful to know that CEO-to-worker pay in Germany, the country with the largest economy in Europe and third largest in the world behind the United States and China, is 12-to-1….

But nothing betrayed the mindset behind America’s growing economic apartheid quite like Republican candidate Mitt Romney notoriously lambasting 47 percent of Americans during last year’s presidential campaign as lazy, entitled people just looking for government handouts. He did this simply because they earn so little that even this country’s regressive tax system deemed it unconscionable to require them to pay income tax (on top of payroll, state, local and other taxes they’re still required to pay). And bear in mind that his audience of “one percenters” nodded amen to his expression of utter contempt for America’s poor, notwithstanding that:

Most of the growth is going to an extraordinarily small share of the population: 95% of the gains from the recovery [since 2008] have gone to the richest 1% of people, whose share of overall income is once again close to its highest level in a century. The most unequal country in the rich world is thus becoming even more so.

(Economist, September 21, 2013)

But I digress.

The point is that this ratio of CEO-to-worker pay merely compounds a profound normative shift in America. For we have gone from the 1950s when CEOs had vested interests not only in the welfare of their workers but that of the communities in which they lived as well, to today when they have vested interests only in the bottom line and share value … because these provide the economic pretext for their exorbitant pay.

This let-them-eat-cake mindset has misled Walmart to pay its CEO, Michael Duke, over 1000 times more than the average worker and still insist, with nary a pang of guilt or hypocrisy, that it makes no business sense to pay its workers a fair minimum wage.

This let-them-eat-cake mindset has misled Walmart to pay its CEO, Michael Duke, over 1000 times more than the average worker and still insist, with nary a pang of guilt or hypocrisy, that it makes no business sense to pay its workers a fair minimum wage.

Hell, J. C. Penny thought nothing of paying Ron Johnson a CEO-to-worker ratio of 1,755-to-1. And Johnson, in turn, thought nothing of firing 19,000 workers (according to March 1, 2013 edition of Business Insider) in a mercenary bid to increase share value … and justify his pay. As it happens, despite using his workers as sacrificial lambs to Wall-Street speculators, J.C. Penny lost half its share value, which is why Johnson lasted only 17 months as CEO.

Incidentally, this focus on share value at the expense of all else explains why investment bankers became little more than snake-oil salesmen who saw customers as nothing more than marks to generate profits. And this in a nutshell explains how bankers precipitated the worst global financial crisis since the Great Depression.

Significantly, the phenomenon of CEOs cutting out the middlemen (i.e., firing managers) is exacerbating not only this CEO-to-worker pay but also the gap between rich and poor in America at large:

J.C. Penney cut a bunch of middle managers across the country on Monday… One source says that the number may now be in the thousands.

J.C. Penney didn’t immediately answer requests for comment, but a spokesperson did mention yesterday that the retailer will be ‘operating with fewer layers of management.’

(Business Insider, May 3, 2013)

But, again, just as the inequities that buttressed South Africa’s political apartheid so offended that country’s collective conscience that they had to be redressed, the inequities that buttress America’s economic apartheid will eventually so offend this country’s collective conscience that they too will have to be redressed.

I can think of no better way to frame the cause for radical change in this respect than to proffer the following rhetorical question, which a Chicago alderman posed to Walmart’s CEO:

How can you go to bed at night and sleep knowing you make this kind of money and the people working for you can hardly buy a package of beans and rice?

(ABC News, July 2, 2010)

For, as obscenely paid CEOs continue to scrap for every morsel, questions like this might serve as a clarion call for workers to organize (as they did in the early 20th century) to demand better wages and other benefits.

For, as obscenely paid CEOs continue to scrap for every morsel, questions like this might serve as a clarion call for workers to organize (as they did in the early 20th century) to demand better wages and other benefits.

But just think for a moment how self-serving and myopic, if not unpatriotic, American CEOs have become: for they have gone from the Henry-Ford model of increasing wages and benefits to retain worker loyalty and reduce turnover with its associated costs, to the Ron-Johnson model of squeezing as much production out of as few workers for as little in wages and benefits as possible to maximize shareholder profits and guarantee even fatter paychecks for themselves.

Hell, one could be forgiven for thinking that if CEOs could increase shareholder value by firing all workers and producing nothing by smoke and mirrors, they would do so.

Mind you, I’m under no illusion that the poor are going to revolt against the rich in America today for the same reasons the poor revolted against the rich in France in the late 1780s – most notably, taxes that favored the rich who looked down on the poor with unbridled contempt.

Not least because the cultural pathology of aspiring to be rich in America today is such that many of the 47 percenters Romney damned as parasites actually voted for him. Not to mention the self-abnegating folly inherent in so many poor and uninsured folks siding with Republicans in damning President Obama’s efforts to provide the guaranteed health insurance they clearly need. In other words, for some twisted reason far too many workers these days seem to think they have more common interest with the CEO than with fellow workers….

I just think that, in due course, even these poor fools will see gestures like billionaires signing pledges to give away at least half of their fortunes to charity, which 60 Minutes championed last night as “the golden age of philanthropy,” as no consolation for an economic system that enables the few to continue making billions off manufactured rises in stock prices, while the many – who actually manufacture things – continue to get laid off.

I just think that, in due course, even these poor fools will see gestures like billionaires signing pledges to give away at least half of their fortunes to charity, which 60 Minutes championed last night as “the golden age of philanthropy,” as no consolation for an economic system that enables the few to continue making billions off manufactured rises in stock prices, while the many – who actually manufacture things – continue to get laid off.

So here’s to the “descent into angry populism” the Economist warned would come if America does not take aggressive, systemic steps to cut the growing gap between rich and poor. And, with all due respect to opposition by the Chamber of Commerce, these steps should begin with Congress passing the Fair Minimum Wage Act of 2013, which would provide at least 30 million Americans with fairer pay for their hard work.