Long before predatory trading in shady financial instruments – with no intrinsic value – caused Lehman Brothers to fail, the fall of Enron symbolized the fateful fallacy of building profits based on manipulations of corporate balance sheets.

In fact, Enron’s trading in such exotic “commodities” as broadcast time for advertisers, weather futures and Internet bandwidth was considered every bit as flawed, and in many cases fraudulent, as Lehman’s trading in such exotic instruments as Collaterized Debt Obligations and Credit Default Swaps. For example, Enron made billions on a trading scheme called ‘death star,’ in which it finagled payment for moving energy to relieve congestion without actually moving any energy or relieving any congestion.

This, of course, makes one wonder why Wall Street banks did not learn the lessons of Enron. Especially since the fallout from their corporate schemes in 2008 made that which followed the fall on Enron in 2001 seem not only like ancient history but also like nothing major.

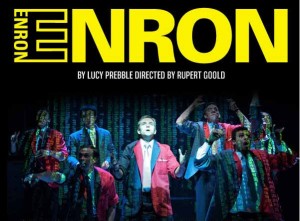

Which brings me to Enron – the play: because after a spectacular rise to the top of the theatre world in London, this elaborate farce suffered a spectacular fall on Broadway this week.

Which brings me to Enron – the play: because after a spectacular rise to the top of the theatre world in London, this elaborate farce suffered a spectacular fall on Broadway this week.

No doubt the production itself was first rate. It’s just that the real-life farce surrounding the fall of the masters of the universe on Wall Street over the past 18 months made selling a play about the fall of Enron in New York seem rather like selling ice to Eskimos. Perhaps this is why it received such chilly reviews by the hit-making theater critics of the New York Times and the Associated Press.

Indeed, I can imagine nothing more entertaining in this context than congressional hearings that were held recently on the Wall Street financial crisis – complete with senators spewing political and moral indignation laced with profanity at disgraced investment bankers. Specifically, no matter how compelling actors can make Enron’s leading characters (Jeff Skilling, Andy Fastow and Ken Lay) appear on Broadway, their portrayal could hardly match the drama that unfolded when Wall Street’s leading characters (Lloyd Blankfein, Dick Fuld, and Fabrice “Fabulous Fab” Tourre) appeared on Capitol Hill.

This I suspect is why Enron was conspicuously absent when the Tony nominations for best play were announced on Tuesday. And this snub evidently precipitated yesterday’s announcement that the play will fold on Sunday after only 15 performances.

There’s absolutely no argument that what Skilling and Fastow and Lay did was terrible and wrong. However, is there also something in us – which means that we are bound into this boom and bust situation – that we constantly create these bubbles out of excitement and fervor and then destroy ourselves? And it happens again and again and again.

This is the pithy exposition playwright Lucy Prebble offered of her own play in an interview with NPR on April 30, 2010. Ironically, it explains the flaw inherent in her art-imitating-life play – since life, in this case, is so much more dramatic, interesting, and entertaining than art.

Leave a Reply

You must be logged in to post a comment.