Yesterday the U.S. Senate held an all day dog and pony show – in the guise of a committee hearing – on the role Goldman Sachs played in precipitating the great recession of 2008. But within minutes it became dramatically clear that this financial crisis was caused in large measure because the brainiacs on Wall Street were behaving as if they were running casinos instead of investment banks.

Nothing demonstrated this quite like the fact that only one of the four erstwhile masters of the universe who testified could state without equivocation that Goldman had a duty to act in the best interest of its client.

There’s a fundamental conflict in Goldman’s selling to clients home-loan securities that company e-mails showed its own employees had derided as “junk” and “crap” – and then betting against the same securities and not telling the buyers… They’re buying something from you, and you are betting against it. And you want people to trust you. I wouldn’t trust you,”

(Democratic Senator Carl Levin of Michigan, Associated Press, April 27, 2010)

Indeed, this begs the question: why would anyone want to do business with this bank if its business purpose is only to make money for its fat-cat partners and overpaid employees?

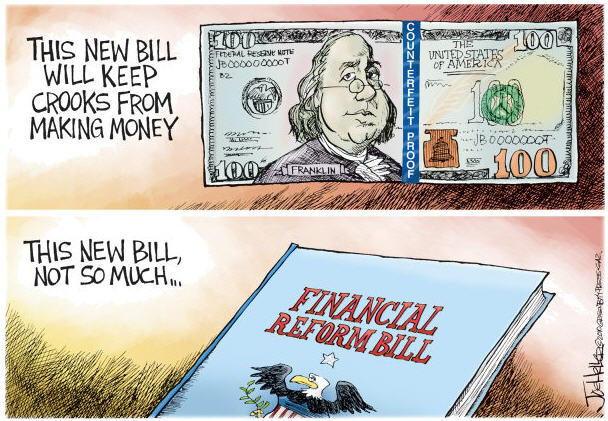

But here’s the more fundamental question for the long-term health of the U.S. economy: If bankers (at Goldman and other investment banks) see nothing wrong with gambling away their clients’ money and then looking for tax payers to bail them out, what hope is there of ever reforming Wall Street?

In Las Vegas people know the odds are against them. They play anyway. On Wall Street, they manipulate the odds while you’re playing the game.

(Republican Senator John Ensign of Nevada, Associate Press, April 27, 2010)

Talk about a moral hazard….

Leave a Reply

You must be logged in to post a comment.