The G-20 is comprised of 19 of the world’s most developed countries plus the EU. Its purported mission is to “strengthen the international financial architecture and to foster sustainable economic growth and development.”

But nothing demonstrates its failure in this respect quite like the fact that G-20 countries were the architects of the financial house of cards that has now fallen and has the world teetering on the precipice of a 1930s-style depression.

And G-20 leaders compounded this failure by doing nothing to strengthen the international financial architecture. This, despite the communiqué they issued at an emergency summit in Washington just six months ago, in which they promised to take coordinated and substantive steps to do so. In fact, reports are that 17 members actually enacted protectionist legislation in direct contravention of that communiqué..

To reinforce the point, recall that G-20 leaders became notorious by their failure to take concrete steps to cut greenhouse gas emissions despite promising to do so by signing the highly touted Kyoto Protocol on global warming.

This record of failure is what informed my cynical belief that the communiqué coming out of this week’s summit would be full of “pious words and general principles” signifying nothing.

Never mind that the foundation for failure was laid even before the summit convened: with US President Barack Obama and UK Prime Minister Gordon Brown advocating large infusions of cash to stimulate the economies of developed countries as the panacea on the one hand; and French President Nicolas Sarkozy and German Chancellor Angela Merkel advocating an international body to regulate financial institutions in those same countries on the other.

I agree with the Obama-Brown prescription, especially since it also recognizes the need to supplement stimulus with more regulation … but only at the national level; whereas, Sarkozy-Merkel’s rejects outright any need to supplement regulation with more stimulus.

That said, here’s how British PM Gordon Brown, the host of this summit, summed up this latest communiqué that I fear will do nothing to resolve this global financial crisis:

That said, here’s how British PM Gordon Brown, the host of this summit, summed up this latest communiqué that I fear will do nothing to resolve this global financial crisis:

Today the largest countries of the world have agreed on a global plan for economic recovery and reform… For the first time we have a common approach to cleaning up banks around the world to restructuring of the world financial system. We have maintained our commitment to help the world’s poorest.

(PM Gordon Brown, Associated Press, April 2, 2009)

Nevertheless, it is noteworthy that the communiqué calls for a $1.1 trillion stimulus fund – from which the IMF and World Bank will purportedly offer loans to developing countries to help rescue their sinking economies. But this is hardly the stimulus (for all G-20 economies) that Obama and Brown sought. Not to mention how oxymoronic the world’s poor countries – already beset by debts owed to these G-20 countries – might find the prospect of incurring more debt to lift themselves out of poverty.

Likewise, the communiqué sets forth a set of principles and guidelines to “regulate” how financial institutions conduct their business and how much they pay their executives. But this is hardly the binding regulation (of all G-20 economies) that Merkel and Sarkozy sought.

Incidentally, Obama practically acknowledged that the only countries that will have to abide by these guidelines and principles are the tax havens that have become piñatas on to which G-20 leaders have deflected blame for failing to regulate financial institutions in their own countries.

At any rate, this communiqué is conspicuous by the omission of any measure that would limit the power of G-20 leaders to continue managing their respective economies according to perceived national interests; the global economy be damned. This of course renders patently absurd all of the right-wing propaganda about a secret agenda to create a global government.

That, in a nutshell, is the practical import of this communiqué.

But let me hasten to note that the failure of the G-20 to codify concrete steps to resolve this financial crisis will not precipitate another great depression; not least because:

In 1929, the US government did nothing and the fall on Wall Street led to the Great Depression; whereas today, it has moved over one trillion dollars (i.e., $1,000,000,000,000.00) in place to cushion the fall… [That cushion has now ballooned to between three and ten trillion dollars depending on which authoritative source one cites.]

[The difference between the fall in 1929 and today, The iPINIONS Journal, September 20, 2008]

It is also noteworthy that Brown made a point of endorsing the transformative sentiments being expressed of late by socialist leaders from Russia and China when he declared that this summit marks the end of the Washington consensus; i.e., of American-style political and economic policies as the blueprint for global development. And, given that the Americans precipitated this global financial crisis, Brown can be forgiven his political opportunism. But I suspect it will only take a humanitarian crisis (like another Tsunami) or a military crisis (like a nuclear Iran) for American exceptionalism to be heralded once again.

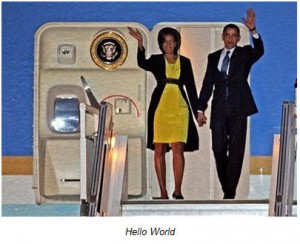

Finally, that the press paid far more attention to everything Michelle Obama’s wore than to anything her husband or any other leader said only guarantees that this summit will be remembered more for its style than for its substance.

Finally, that the press paid far more attention to everything Michelle Obama’s wore than to anything her husband or any other leader said only guarantees that this summit will be remembered more for its style than for its substance.

But I think it was awfully classy of former supermodel Carla Bruni, the wife of the French President Nicolas Sarkozy, to stay at home to avoid upstaging Michelle on her first foray onto the international first-lady catwalk….

NOTE: Given my reference above to the failures of the Kyoto Protocol, I won’t even address the communiqué’s platitudes on climate change. And the motley crew of protesters / anarchists who always try in vain to disrupt these summits have become so prosaic and irrelevant that they are not worthy of any further comment.

Related commentaries:

Blaming white people with blue eyes for global financial crisis

Difference between fall in 1929 and today

Leave a Reply

You must be logged in to post a comment.