No doubt you recall that conservative economists were warning in 2009 that President Obama’s stimulus package would lead to a double-dip recession and trillion-dollar deficits in perpetuity.

His stimulus measures were aimed at boosting economic recovery by, among other things, increasing government spending on everything from infrastructure to unemployment insurance. But Republicans claimed that, by implementing them, Obama was cluelessly turning the U.S. economy into a European-style, recession-plagued socialist one.

His stimulus measures were aimed at boosting economic recovery by, among other things, increasing government spending on everything from infrastructure to unemployment insurance. But Republicans claimed that, by implementing them, Obama was cluelessly turning the U.S. economy into a European-style, recession-plagued socialist one.

Except that, from day one of his presidency, Republican politics has been governed by a tortured and hypocritical logic that continually defies common sense. Which is why, in this case, it never gave Republican politicians pause to be damning Obama for his so-called European-style economic policies on the one hand, while urging him to emulate the austerity European leaders were implementing on the other hand.

Their austerity measures were aimed at boosting economic recovery (and, perhaps more importantly, reducing budget deficits) by, among other things, reducing government spending and cutting pensions and salaries. And Republicans claimed that only such measures would stimulate the economy, create jobs, and avert a prolonged recession … if not an economic depression.

I am on record siding with Obama when this stimulus-vs.-austerity debate was brought into stark relief at a gathering of world leaders at the 2009 G20 Summit in London, England:

I am on record siding with Obama when this stimulus-vs.-austerity debate was brought into stark relief at a gathering of world leaders at the 2009 G20 Summit in London, England:

I agree with the Obama-Brown prescription, especially since it also recognizes the need to supplement stimulus with more regulation; whereas the Sarkozy-Merkel prescription relies on austerity measures and rejects outright any need to supplement regulation with more stimulus.

(“G20 Fails to Stimulate or Regulate Global Economy,” The iPINIONS Journal, April 3, 2009)

Well, based on key macroeconomic indicators, the verdict is in.

In the United States with its emphasis on stimulus:

- Unemployment is down to 7.6 percent today, from 10 in October 2009.

- The DOW rose to an all-time high of 15,354.40 on Friday, from a low of 6,547.05 in March 2009 (less than two months into Obama’s presidency).

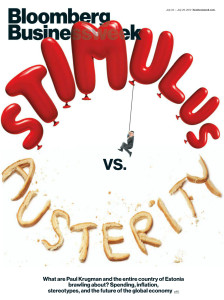

- The deficit has returned to the lowest level since the summer of 2008 at $669 million for fiscal year 2013. What’s more, far from the ballooning, trillion-dollar deficits in perpetuity Republicans warned about, the non-partisan CBO projects budget deficits of just half that amount. According to the March 12, 2013 edition of Bloomberg Businessweek – featuring the “Single Best Chart,” the deficit peaked as percentage of GDP at 10.4 percent in December 2009; it fell to 6.7 last year; and the CBO estimates that it will fall to 2.0 percent next year.

- Debt as a percentage of GDP is 73.6.

- This country has enjoyed 15 quarters of positive growth in GDP since Obama’s stimulus began to take effect in the third quarter of 2009.

By contrast, in the 17-nation Eurozone with its emphasis on austerity:

- Unemployment is up to 12.1 percent (and rising) today, from 8.2 in January 2009.

- Deficit as a percentage of GDP is only 4 percent.

- But debt as a percentage of GDP is 82.5.

- This zone has suffered 5 quarters of negative growth in GDP, causing leading economists to conclude that:

At some point soon, Eurozone governments will be forced by voters to reverse austerity and stimulate growth…

Based on this unfolding evidence, one cannot escape the conclusion that, to date, austerity policies not only have not achieved their objectives, but they have actually proven to be counter-productive. It is now obvious to all that the current European macroeconomic policy orthodoxy is misplaced in the new era of high debt and renewed recession.

(VOX, March 3, 22013)

In fact, no less a person than Zanny Minton Beddoes, economics editor at The Economist, echoed this damning verdict on Sunday’s edition of GPS with Fareed Zakaria on CNN. Specifically, she declared that the Eurozone’s prolonged recession is in fact an indictment of austerity.

In fact, no less a person than Zanny Minton Beddoes, economics editor at The Economist, echoed this damning verdict on Sunday’s edition of GPS with Fareed Zakaria on CNN. Specifically, she declared that the Eurozone’s prolonged recession is in fact an indictment of austerity.

Therefore, contrary to Republicans urging Obama to emulate European leaders’ austerity policies, the more prudent thing would have been for European leaders to emulate (or copy – as would more likely be the case) Obama’s stimulus policies.

But pigs will fly before Republicans acknowledge the irony that, because Obama had his way (mostly), the United States has not ended up like Europe (i.e., mired in recession with record-high unemployment). Instead, they will do or say anything to avoid having to explain how their prescription for economic recovery could have been so wrong. Perhaps this explains why they’ve been deflecting blame/shame in recent weeks by trying to tar and feather Obama with all manner of faux scandals to make it seem as if he is as every bit as crooked as Richard Nixon.

But nothing indicates how wrong they are in this respect as well quite like Sunday’s CNN/ORC poll, which found that Obama’s job approval is 53 percent (i.e., up from the 51.1 that led to his re-election last November).

But nothing indicates how wrong they are in this respect as well quite like Sunday’s CNN/ORC poll, which found that Obama’s job approval is 53 percent (i.e., up from the 51.1 that led to his re-election last November).

Mind you, this is not to say that austerity measures cannot work. After all, indications are that slashing wages and cutting government spending helped Latvia recover from the 2008 financial crisis better than any of the Eurozone countries it hopes to join next year. But surely it is self-evident why austerity might work for the economy of this peripheral country but not for that of a major power like the Eurozone or the United States, no?

I am also acutely aware that the quantitative easing (QE) monetary policy of the Federal Reserve has had a stimulative effect on the U.S. economy. QE primarily involves the Fed buying government securities and bonds from financial institutions to increase money supply, thereby promoting increased lending and liquidity. That the European Central Bank has failed to implement a similar policy is just another indication of how the Eurozone’s overall focus on austerity has affected or inhibited sound, adaptive fiscal policies. To be fair, though, the printing of money involved in QE might contravene EU treaties….

I commented more on the reasons stimulus is generally better than austerity for, well, stimulating economic growth in “Rational Markets vs. Keynesian Economics,” The iPINIONS Journal, September 23, 2011:

I applaud Obama for finally proposing a Keynesian jobs bill that focuses more on government spending to rebuild the country’s infrastructure and improve other areas (like education and law enforcement) than on catering to financial institutions that do little more than inject irrational exuberance or irrational fear into the economy.

Related commentaries:

G20 fails…

Rational markets…