Just when I thought the banking industry could not fall any lower into disrepute came reports last week that the bad trading loss at JPMorgan Chase could exceed $9 billion.

Just when I thought the banking industry could not fall any lower into disrepute came reports last week that the bad trading loss at JPMorgan Chase could exceed $9 billion.

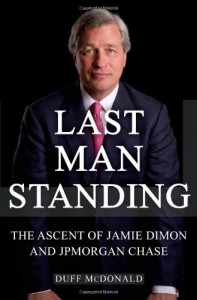

This stands in stark contrast, of course, to the estimate of a $2 billion loss its primping peacock of a president, Jamie Dimon, dismissed in May as “no big deal.” What’s more it makes a mockery of JPMorgan’s self-aggrandizing reputation as the only major Wall Street bank that was not so affected by the sub-prime mortgage mess that it had to go, hat in hand, to Washington for a bailout.

Hell, at this rate, JPMorgan really should go the way of the failed Lehman Brothers. Oh right, it’s now too big to fail. (So much for the Dodd-Frank finance reform bill, eh?)

Now – as if those reports were not worrying enough – come reports this week that UK bankers were engaged in an institutionalized conspiracy to rig the interbank lending rate (aka the LIBOR ). This is the rate banks pay to borrow from each other and it underpins transactions valued in the trillions.

More crucially though this is the benchmark rate banks use to set interest rates for mortgages, credit cards, and loans. In other words, by rigging the interbank rate bankers could make all of these rates more expensive or cheaper.

In announcing a parliamentary inquiry into this latest banking scandal, UK Prime Minister David Cameron promised that:

Bankers who have acted improperly should be punished.

(The BBC, July 2, 2012)

Never mind that this is what President Obama said three years ago about the Wall Street bankers who acted … improperly. And we are still waiting to see them punished….

In any event, the bankers caught red-handed in this case are from Barclays. But, just as all major U.S. banks were involved in peddling sub-prime mortgages as AAA investments, there seems little doubt that all major UK banks have been rigging the interbank rate too.

In any event, the bankers caught red-handed in this case are from Barclays. But, just as all major U.S. banks were involved in peddling sub-prime mortgages as AAA investments, there seems little doubt that all major UK banks have been rigging the interbank rate too.

Apropos of this, the interconnected nature of banking these days is such that I would not be at all surprised by reports that American bankers have been rigging the U.S. interbank rate (aka the federal funds rate). Indeed, that Barclays agreed to pay part of its $450 million fine to the U.S. Department of Justice suggests as much. Alas, this would mean that U.S. borrowers would’ve been getting shafted on mortgages, credit cards, and loans right along with UK borrowers….

I should leave it there because delving any further would risk making this scandal seem more sophisticated than the garden-variety conspiracy to fudge the numbers that it is. Except that I feel constrained to note that it reinforces what I’ve been saying about these high-brow bankers ever since their institutionalized fraud and incompetence precipitated the Great Recession of 2008 – from which the world is still struggling to recover.

For example, here:

A number of people have asked in recent months why I have written so little about the sub-prime mortgage mess and its impact on the U.S. economy. I invariably replied that I didn’t have a clue what to make of the mess or what it portends… Little did I know, however, that the masters of the universe on Wall Street were even more clueless…

It’s only a matter of time before this meltdown [on Wall Street] comes to Main Street, making daily transactions at commercial banks (e.g. getting a car loan or a mortgage) much more expensive.

(“Chickens Come Home to Roost…,” The iPINIONS Journal, September 16, 2008)

And here:

This scandal confirms my abiding suspicion that much of the U.S. financial market is little more than a house of cards, in which croupiers with MBAs continually shuffle decks to determine winners and losers.

(“Madoff Biggest Wall Street Scam in U.S. History,” The iPINIONS Journal, December 16, 2008)

To be fair, British bankers (or bankers who work in Britain) are distinguishing themselves as this global financial crisis continues to unfold in at least in one respect. For, unlike their American counterparts (like the abovementioned Mr. Dimon), their CEOs have had the decency and self-respect to resign after being exposed as managers of such incompetent, corrupt, costly, and scandalous enterprises. Which is why the homophonically named CEO of Barclays, Bob Diamond, tendered his resignation today.

Related commentaries:

Chickens come home…

Madoff…